'$HYPE' Of Hyperliquid: A Deep Dive

Will this DEX live up to its potential?

Introduction @ Hyperliquid

Decentralized exchanges (DEXs) are playing a pivotal role in the evolution of trading crypto tokens, offering users greater control and transparency compared to traditional centralized exchanges. With the rise of DeFi and the maturation of crypto infrastructure, DEXs are becoming increasingly crucial for facilitating high-speed, secure transactions.

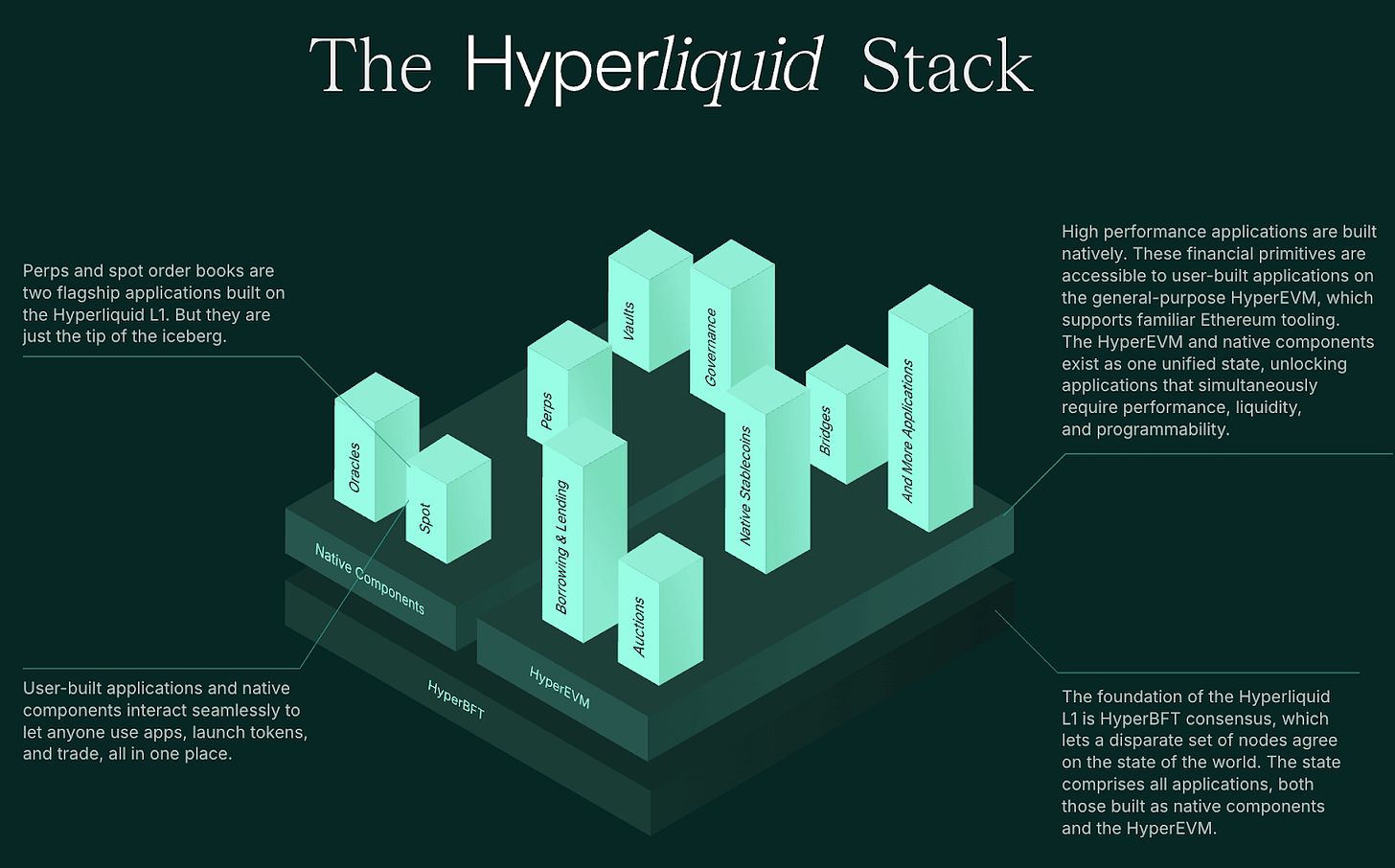

Hyperliquid is a pioneering decentralized exchange (DEX) built on its high-performance Layer-1 blockchain, HyperEVM. This ecosystem is designed to bridge the gap between centralized finance (CeFi) and decentralized finance( DeFi). The platform combines the benefits of centralized exchanges (CEXs) with the transparency and security of decentralized finance (DeFi).

DEX vs CEX: Battle For The Masses

Despite the dominance of CEXs in terms of liquidity and user base, DEXs are gaining traction due to their decentralized nature and enhanced security features. Both types of exchanges are expected to coexist, with CEXs focusing on onboarding new users and DEXs catering to those seeking greater autonomy and security

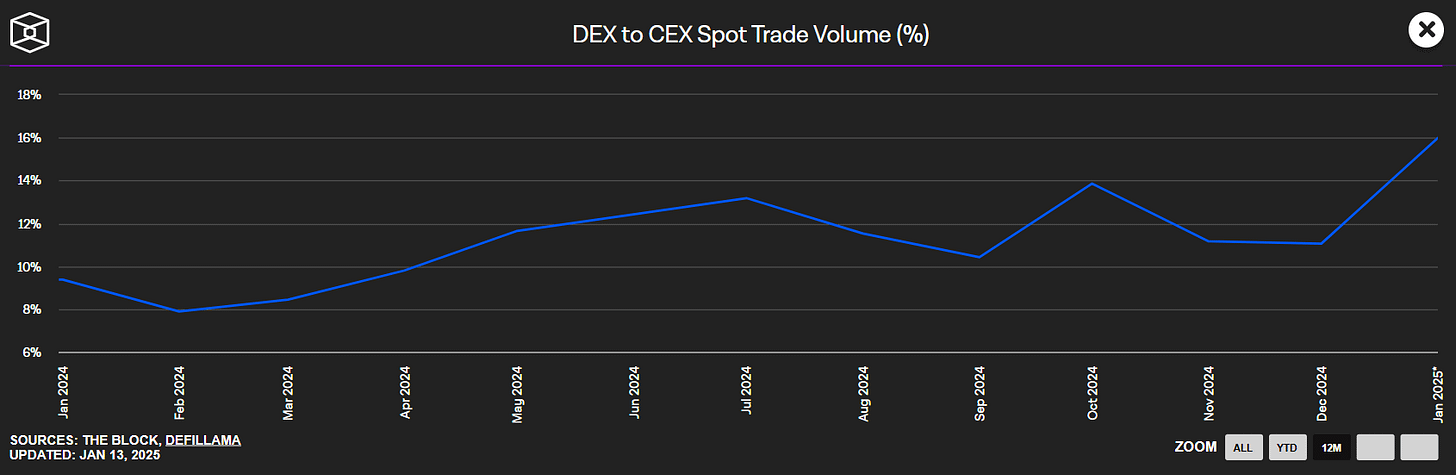

In 2024, the top 10 CEXs processed tens of trillions of dollars in trading volume, significantly outpacing DEXs. However, DEXs collectively processed over $1.76 trillion in spot trading volume, increasing their share from 9.37% in January 2024 to nearly 16% by January 2025. DEXs have experienced rapid growth, with some platforms recording quarter-on-quarter growth rates exceeding 200%.

This growth is driven by the increasing adoption of decentralized finance (DeFi) solutions and the emergence of new public chain projects. Hyperliquid has been a major highlight amongst this growth of the Defi sector. Currently, Hyperliquid has captured a dominant market share exceeding 38% in the Defi perpetuals trading space. It recorded quarterly trading volumes of around $900 million.

Tech @ Hyperliquid

HyperBFT Consensus Algorithm: Hyperliquid utilizes a custom-built consensus algorithm called HyperBFT, which is based on the efficient HotStuff protocol. It ensures ultra-low latency of 0.2-0.9 seconds, making it ideal for derivatives trading. It can process up to 100,000 orders per second, rivaling the performance of top centralized exchanges.

On-chain order book: Unlike many DEXs that use automated market makers (AMMs), Hyperliquid employs a fully on-chain order book.

Decentralized Clearing House: The platform features a decentralized clearing house that manages margin balances and supports both cross-margin and isolated-margin trading, offering traders flexibility and risk management options.

Beyond its flagship DEX, Hyperliquid is expanding its ecosystem with projects like HyperLend, HyperSwap, and Kinetiq. This suite of products positions Hyperliquid as an all-encompassing solution in the world of DEX trading.

Tokenomics of ‘Hype’ token:

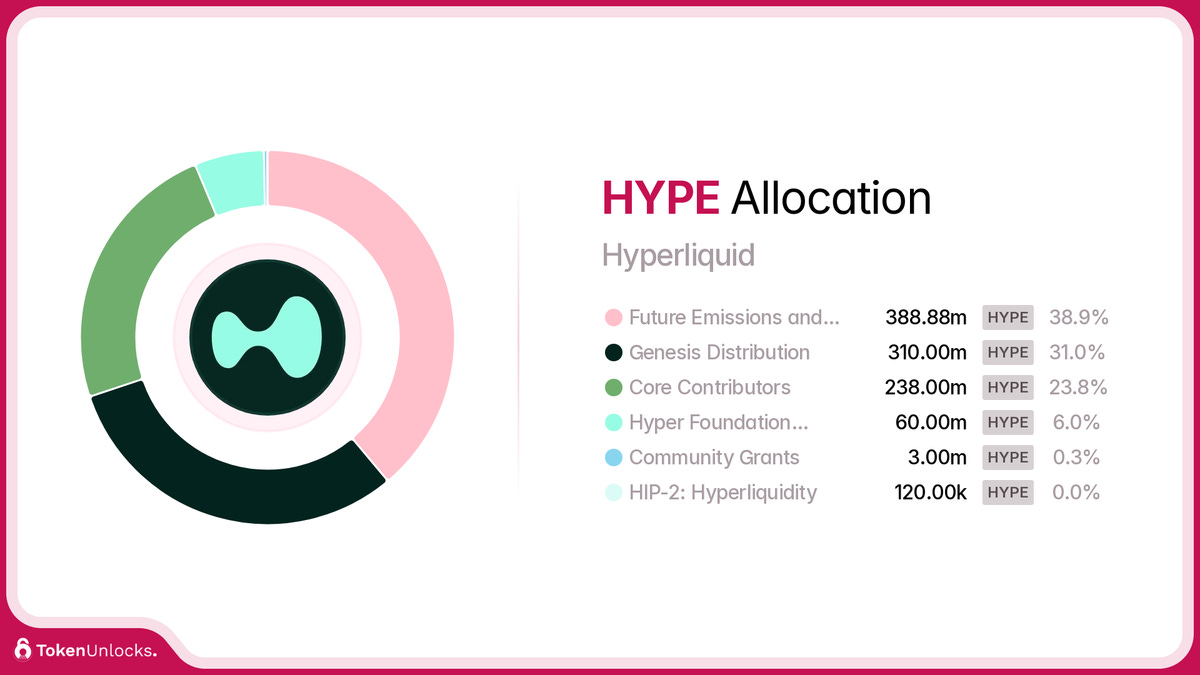

The HYPE token is the native cryptocurrency of the Hyperliquid ecosystem, serving as the backbone for its operations and user engagement. The total supply of HYPE tokens is capped at 1 billion tokens, ensuring scarcity and maintaining value over time.

Future Emissions & Community Rewards: 38.89% of the tokens are allocated for future emissions and community rewards, fostering ongoing engagement and growth.

Genesis Distribution: 31% of the tokens were distributed via airdrop, marking one of the largest airdrops in DeFi history.

Core Contributors: 23.8% of the tokens are reserved for core contributors, recognizing their role in developing and maintaining the platform.

Hyper Foundation Budget: 6% of the tokens support the Hyper Foundation, which oversees strategic initiatives and development.

Community Grants: A small portion, 0.3%, is dedicated to community grants, promoting innovation and community-driven projects.

Team@ Hyperliquid:

Jeff Yan and Iliensic: Co-founder of Hyperliquid, classmates and Harvard graduates. Jeff worked at Hudson River Trading and later worked at Google as a software engineer, developing trading algorithms.

In 2020, Jeff founded Chameleon Trading, a crypto market-making firm that became one of the largest in the industry by 2022. After the FTX collapse, he co-founded Hyperliquid to address the need for a decentralized exchange.

Iliensic also has a deep understanding of trading infrastructure and blockchain technology, which has played a crucial role in the development of Hyperliquid’s high-performance, decentralized exchange. He works behind the scenes, focusing on the platform's trading infrastructure and blockchain technology.

The core contributors behind Hyperliquid include members from prestigious institutions and notable companies such as Caltech, MIT, Airtable, Citadel, Hudson River Trading, and Nuro. Hyperliquid's success is a testament to the strong foundation laid by its co-founders and core contributors.

Investors @

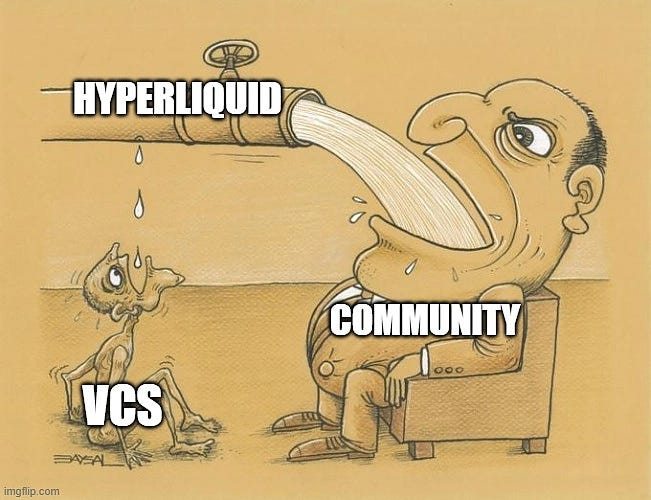

Hyperliquid is primarily self-funded, emphasizing independence from external capital. The platform has consciously chosen to operate without venture capital involvement, maintaining complete control over its development and governance. Hyperliquid generates revenue primarily through platform fees and token auctions, redistributing 100% of trading fees back to its community(developers, founders, contributors, users).

The Token Generation Event(TGE) of the ‘HYPE’ token by the Hyperliquid Foundation took place on November 29, 2024. Notably, 31% of the total HYPE supply was distributed during the Genesis airdrop to over 90,000 early adopters. In total, approximately 76% of HYPE tokens are reserved for community distribution, reinforcing Hyperliquid's focus on creating an inclusive and equitable ecosystem.

Hyperliquid’s approach emphasizes a commitment to decentralization and community engagement, ensuring the interests of its Defi products without any external pressure. By prioritizing user ownership and participation, Hyperliquid aims to build a robust platform that thrives on its contributors rather than speculative investments.

Partnership & Updates@Hyperliquid:

Hyperliquid continues to drive innovation in the Defi sector while strengthening its dominance through timely updates, long-term partnerships, and meaningful collaborations.

1: Fee Structure Overhaul:

Starting April 30, 2025, Hyperliquid will introduce staking tiers for HYPE token holders, offering reduced trading fees of up to 40%. The fee system will also differentiate between Spot and contract markets, with weighted trading volumes for fairer calculations. Default rates will increase, boosting protocol revenue and utility for HYPE tokens.

2: Nansen X HypurrCollective:

Blockchain analytics leader Nansen partnered with HypurrCollective, forming a strategic collaboration to foster innovation, governance, and community-driven growth within the Hyperliquid ecosystem. The announcement in late December 2024 centers on a genesis validator, one of only 16 available, which empowers HYPE token holders to stake their assets with a unique 1-day lockup period, near-instant unstaking, and a competitive commission rate to maximize rewards while actively contributing to the network’s decentralized governance.

3: Integration of Phantom Perps via Builder codes:

One of the standout developments is the integration of Phantom Perps via Builder Codes, a partnership that has opened new revenue streams estimated to generate 2%-4% in annual growth. This collaboration has already brought over 20,000 new users to the Hyperliquid ecosystem and is expected to expand significantly as more applications join the Builder Codes program.

4: Expansion of validator nodes:

An important milestone was the expansion of validator nodes from an initial four to over 25, effectively decentralizing and strengthening network security. The platform also introduced innovative features like the “Staking Tiers” system, which rewards HYPE token holders with fee discounts ranging from 5% to 40%, motivating deeper community engagement.

5: Expansion of stablecoin portfolio:

Hyperliquid extended its stablecoin portfolio with the recent addition of Ethena’s USDe and USDT0 stablecoins available on both the Hyperliquid exchange and HyperEVM. This diversification helps optimize risk and signals Hyperliquid’s commitment to offering a broad range of high-quality digital assets.

Hyperliquid vs Aster:

Launched in late 2024, Hyperliquid has established itself as a dominant force with a robust $5 billion+ total value locked (TVL) and a market capitalization around $13 billion. It operates on its own Layer 1 blockchain optimized for ultra-fast trading speeds—processing up to 200,000 orders per second, with sub-second finality and zero gas fees. This infrastructure gives Hyperliquid centralized-exchange-level execution fully on-chain, appealing to traders seeking stability, speed, and institutional-grade performance. Its tokenomics feature tight supply management with active buybacks, fostering steady market growth and community trust.

Aster, a newer entrant launched in 2025 and backed by Binance Labs and CZ, has quickly made waves in the DeFi community. With a modular design primarily built on the BNB Chain, Aster emphasizes multi-chain interoperability across Ethereum, Solana, and Arbitrum. It introduces novel features such as yield-bearing collateral, hidden orders, and stock perpetuals, offering experimental DeFi-native functionalities. Aster’s token surged dramatically at launch, reaching a market cap of about $2.5 billion.

Trading volume comparisons reveal Aster briefly surpassed Hyperliquid in 24-hour perpetual trading volume, hitting nearly $25 billion versus Hyperliquid’s $10 billion on peak days. Despite this, Hyperliquid maintains deeper liquidity and higher volumes over weekly and monthly periods, sustaining its position as the sector’s benchmark for DEX perpetuals.

Road Ahead @ Hyperliquid:

Hyperliquid’s roadmap for 2025 and beyond is ambitious and focused on completing decentralization, expanding the ecosystem, and solidifying its position as a premier liquidity provider in decentralized finance (DeFi). A key milestone in the near future is deepening the integration of HyperEVM and HyperCore on the mainnet, enabling seamless cross-layer asset transfers and bridging traditional Ethereum Virtual Machine (EVM) applications with Hyperliquid’s high-performance Layer 1 blockchain.

Decentralization remains a critical goal, with network decentralization steadily progressing through the expansion of validator nodes from a handful to over 25, promoting security and trustlessness. Further upgrades will introduce native ERC20 token transfers, enhanced precompiles, and safety mechanisms to boost cross-chain interoperability and developer experience. This will empower developers to build and deploy decentralized applications (dApps) with ultra-fast execution and near-zero fees.

On the product front, Hyperliquid aims to expand its suite of DeFi primitives, attracting not only traders but also liquidity providers and institutional participants by improving staking tiers, fee structures, and yield opportunities. The launch of new stablecoins like USDe and USDT0 on both HyperEVM and Hyperliquid exchange reflects its commitment to diversifying asset support while optimizing risk.

On the product front, Hyperliquid aims to expand its suite of DeFi primitives, attracting not only traders but also liquidity providers and institutional participants by improving staking tiers, fee structures, and yield opportunities. The launch of new stablecoins like USDe and USDT0 on both HyperEVM and Hyperliquid exchange reflects its commitment to diversifying asset support while optimizing risk.

This outlook reflects Hyperliquid’s strategic vision, key technical developments, and growth potential as it aims to lead the next phase of decentralized perpetual exchanges.