Table of Contents:

- Solana: The purple chain of hope

- Validators: Network Warriors

- Role and Significance of Validators

- Challenges faced by Solana Validators

- Structure and Distribution of Fees in Solana

- Role of Fees in Validator Economics

- Solana vs World: Comparing Fee Economics

- Innovation to Support Validator Sustainability

- Economic Mechanisms for Validator Incentives

- Personal Outlook on Solana and Validators

Introduction:

In the world of blockchain technology, Solana is a name that stands out for its speed and efficiency. With its ability to process thousands of transactions per second, Solana has become a popular choice for developers and users alike. However, behind the scenes, there is a complex system of validators and fee economics that keeps the network running smoothly.

According to recent data, Solana has over 1,000 validators, each responsible for verifying transactions and maintaining the network's integrity. This decentralized system ensures that the network is secure, reliable, and the transactions are processed quickly and efficiently. However, the cost of running a validator can be high, and the fees charged for transactions can vary widely.

Thus, in this blog post, we will take a deep dive into the world of Solana's validators and fee economics, uncovering the secrets behind the network's success. We will also explore the economics behind the different types of transaction fees, and how they impact the network's performance.

Solana: The purple chain of hope

Solana, a high-performance blockchain platform, has been making waves in the world of decentralized finance and applications. Known for its lightning-fast transaction speeds and low costs, Solana has emerged as a top contender in the competitive blockchain landscape. With its innovative approach to scalability and decentralization, Solana has attracted developers and users looking for a robust and efficient blockchain solution.

As more developers and users discover the benefits of Solana, its adoption is expected to continue growing rapidly, solidifying its position as a leading cryptocurrency. With its support for DeFi and Web 3.0 applications, strong development community, high throughput of over 65,000 transactions per second, and low transaction fees, Solana is poised to revolutionize the crypto space.

From exploring the decentralized nature of validators to unraveling the intricacies of fee economics, this blog aims to demystify Solana's operational dynamics for both newcomers and seasoned blockchain enthusiasts. Join us on this journey as we understand the inner workings of the network, allowing you to make more informed decisions about how to use the network, and how to optimize your transactions.

Validators: Network Warriors

Solana, a high-performance blockchain platform, has multiple validator clients to ensure network resilience and decentralization. The original Solana validator client was developed by Solana Labs, but since then, several independent efforts have created additional validator clients. Jito Labs released a second validator client in August 2022, which is a fork of Solana Labs code that Jito is independently building and maintaining.

Another independent effort is Firedancer, a new validator client developed from the ground up in C++ by Jump Crypto, with a theoretical throughput of one million transactions per second. Additionally, Syndica announced the development of Sig, a validator client for the Solana network written in the Zig programming language. These diverse validator clients contribute to the long-term health and functioning of the Solana network, mitigating the risk of a single bug or harmful piece of code in a single client, making a total network outage less likely.

In the realm of blockchain networks like Solana, validator software clients, and validators play distinct yet interconnected roles in ensuring network security and efficiency. Validator software clients serve as the foundational software applications that enable validators to participate in the consensus protocol by proposing and attesting to blocks using private keys.

Validators on Solana are computers that run validator client software, serving as the operational backbone of the network. As of October 2023, there are four different validator client implementations actively developed on three independent codebases within the Solana ecosystem. Notably, the Jito Labs client has seen significant adoption among Solana validators, since its inception in August 2022, highlighting the importance of multi-client networks in the world of blockchain.

While the validator software clients form the technical foundation for validators to engage with blockchain networks like Solana, validators themselves are instrumental in executing consensus protocols and securing the network. The evolution towards a multi-client network on Solana underscores the importance of diversity in client offerings for long-term network health and functionality. By embracing a range of validator software clients, Solana continues to strengthen its operational capabilities and resilience in an ever-evolving blockchain landscape.

The stake distribution in Solana is somewhat top-heavy, with large validators run by centralized exchanges receiving a significant share of the stake. Currently, Jito Labs' client software manages 31.45% of validator stakes, while the Solana Labs client software manages 68.55% of validator stakes. However, with the upcoming validator clients such as Firedancer and Sig, you can expect an ever-secure and resilient network.

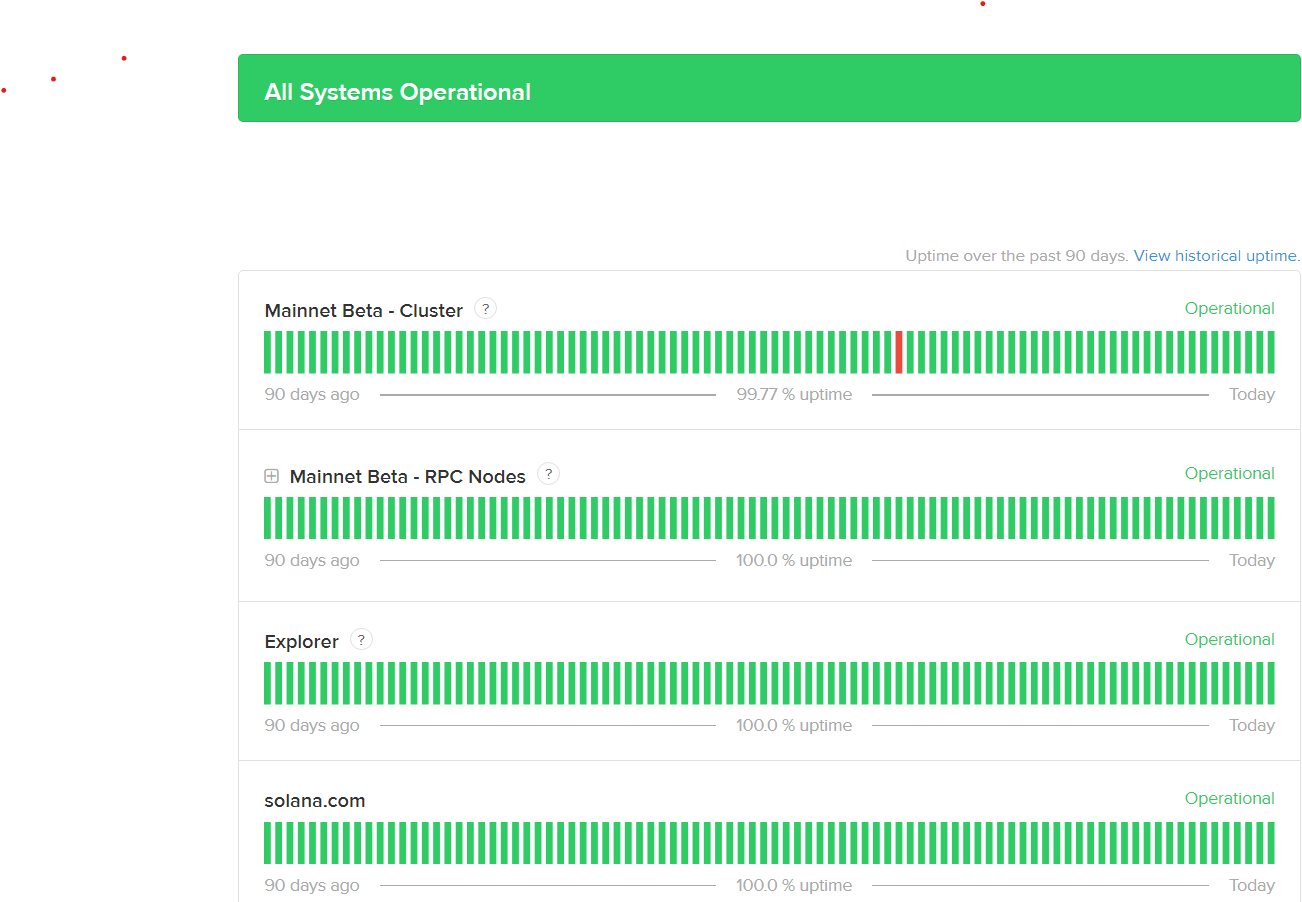

Solana stands out as one of the largest proof-of-stake networks globally in terms of node count, boasting a decentralized structure that surpasses many other blockchains.

The network's decentralization is quantified by the Nakamoto Coefficient, currently standing at 31, which signifies a high level of decentralization.

As shown in the figure above, there are 1500+ block-producing validators on the Solana blockchain as per the Validator Health Report of October 2023. This growth in validator numbers underscores Solana's commitment to expanding its decentralized infrastructure and enhancing the network experience. The distribution of stake among validator software clients and the increasing number of validators on Solana demonstrate the network's continuous evolution towards greater decentralization and resilience.

Role and Significance of Validators

Validators on the Solana network are essential for maintaining blockchain security and ensuring the accuracy of recorded data. They are responsible for executing programs that track all accounts within the Solana cluster and validate transactions before adding them to the network. Without validators, the Solana ecosystem would not be able to function effectively, emphasizing their pivotal role in the network's operations.

1. Securing the Network

Validators help secure the Solana network by producing blocks and voting on the validity of other blocks.

This process ensures that only legitimate transactions are added to the blockchain, maintaining its integrity and preventing malicious activities

By participating in consensus mechanisms and verifying transactions, validators contribute to making Solana a top-notch performer in the L1 network space.

2. Maintaining Decentralization

One of the key responsibilities of validators is to improve decentralization within the Solana network.

By running validator nodes independently, more entities contribute to securing the cluster, reducing its vulnerability to potential attacks or catastrophic events.

This distributed approach enhances network resilience and fosters a more robust and secure blockchain ecosystem.

3. Updating Software and System Maintenance

Validators must keep their systems up-to-date with the latest software releases to ensure optimal performance and security.

Regular maintenance, monitoring, and timely responses to system issues are essential responsibilities for validators to uphold network reliability and operational efficiency.

4. Staking SOL Tokens

Solana validators are required to stake a certain amount of SOL tokens, the native cryptocurrency of the Solana blockchain.

By staking tokens, validators not only contribute to network health and decentralization but also earn rewards in the form of transaction fees and staking rewards.

5. Economic Incentives

Validators have economic incentives for their contributions to the network.

They earn rewards from transaction fees, maximum extractable value (MEV), token inflation, and staking activities.

These incentives encourage validators to maintain honest behavior and actively participate in securing and validating transactions on the Solana blockchain.

Challenges faced by Solana Validators

Solana validators, essential for processing transactions and maintaining the blockchain's security, encounter various challenges in their role within the ecosystem. Here are the main challenges faced by Solana validators as highlighted in the search results:

1. Technical Challenges

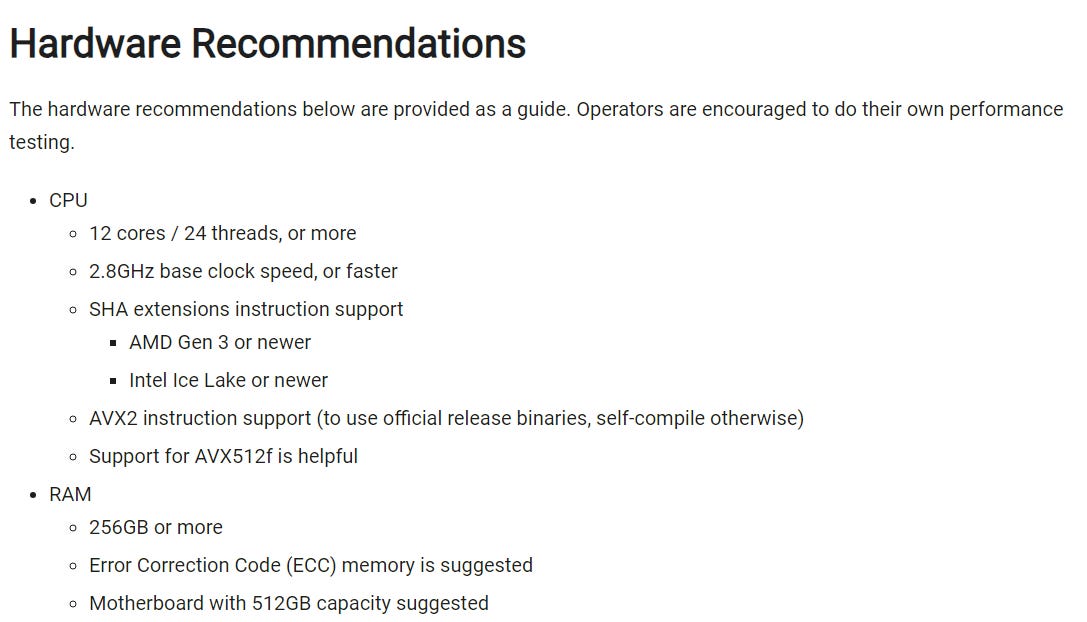

Validators must maintain constant network connectivity and robust hardware to ensure uninterrupted operation.

Technical expertise is crucial for setting up and running a validator node, including configuring the node, generating key pairs, and optimizing system settings.

2. Economic Challenges

Validators are required to stake SOL tokens, facing the risk of slashing for misbehavior or downtime.

Despite economic risks, validators are incentivized through transaction fees and staking rewards.

3. Network Outages and Hardware Requirements

Network outages and the need for high-performance hardware pose significant challenges for validators in the Solana network.

Solana addresses these challenges through network upgrades and initiatives to enhance validator quality.

4. Client Diversity

The lack of client diversity can lead to potential central points of failure, impacting network performance and causing outages.

Having multiple validator clients mitigates risks associated with bugs or malware attacks in a single client, enhancing network resilience.

In conclusion, Solana validators face a combination of technical, economic, and network-related challenges that require expertise, continuous monitoring, and adherence to specific hardware requirements to ensure the smooth operation of the blockchain network. Efforts to address these challenges include network upgrades, improving client diversity, and optimizing stake distribution to enhance the overall health and performance of the Solana ecosystem.

Potential Solutions

Potential solutions for the issues faced by Solana validators include:

1. Network Upgrades

Solana is addressing network outages and hardware requirements through network upgrades, aiming to enhance the overall health and performance of the Solana ecosystem.

2. Improving Client Diversity

The lack of client diversity can lead to potential central points of failure, so Solana is working on increasing the number of validator clients to enhance network resilience.

3. Optimizing Stake Distribution

Solana is optimizing stake distribution to ensure a more geographically distributed stake, making the network more resilient to attacks and outages.

4. Solana Foundation Delegation Program

The Solana Foundation Delegation Program (SFDP) is designed to assist validators with offsetting costs, gradually decreasing support as validators become self-sufficient, encouraging validators to attract external staking and maintain high-performance standards.

5. Future Upgrades

Solana validators should consider future upgrades and their implications, including deterministic scheduling, long-term staking incentives, programmatic slashing, and the introduction of new clients like Firedancer.

These solutions aim to address the challenges faced by Solana validators, such as network outages, hardware requirements, and economic risks, to ensure the smooth operation of the blockchain network.

Structure and Distribution of Fees in Solana

The economic incentives of validators are intricately tied to the structure and distribution of fees within the Solana ecosystem. Fees play a pivotal role in incentivizing validators to secure the network, validate transactions, and maintain the integrity of the blockchain. In this blog section, we will gain a detailed overview of the economics of Solana validators, exploring the fee mechanisms, their distribution, and the impact on validator economics.

On the Solana network, there are different types of fees that users encounter:

1. Base Fees:

The base fees on Solana are calculated based on a statically set base fee per signature, which can range from 50% to 1000% of the target lamports per signature, with the default target per signature currently set at 10,000.

Thus the base fee on Solana is currently set at 0.000005 SOL (5,000 lamports) per signature. This fee is a lump-sum payment made upfront by the user to utilize the network's resources.

It forms the foundation of the transaction cost and is paid regardless of the actual resources used.

2. Priority Fees:

In addition to base fees, Solana introduced optional priority fees to allow transactions to prioritize themselves against others in the leader's queue.

Users can pay a priority fee to expedite their transactions for a higher chance of inclusion in a block. The priority fee is denominated in microlamports per compute unit requested.

3. Rent Exemption Fee:

Solana also charges a fee for creating a new state called rent exemption, which is currently set at 6.96 SOL per MB. This fee is assigned to new accounts and can be recollected when the account is removed.

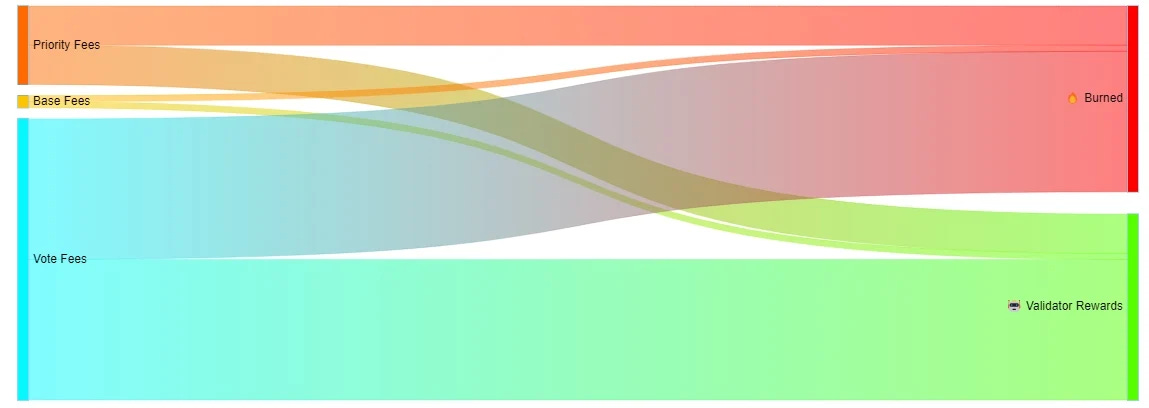

4. Transaction Fee Distribution:

Currently, 50% of all transaction fees on Solana are burned, while the remaining 50% are distributed to the leading validator who proposed the block.

These fees play a crucial role in maintaining network performance, preventing spam, and incentivizing validators on the Solana blockchain. The structure of these fees aims to balance supply shocks while accurately pricing demand based on network conditions at any given time.

Role of Fees in Validator Economics

Transaction fees form the cornerstone of Solana blockchain's validator economics, playing a pivotal role in sustaining the network, compensating validators, and fortifying the economic framework. These fees, though seemingly small, have far-reaching implications that contribute to the robustness and longevity of the Solana ecosystem.

1. Purpose of Transaction Fees

Transaction fees serve a multi-faceted purpose within the Solana blockchain. They are not merely compensation for validators but act as a fundamental mechanism for maintaining the health of the network. By compensating validators for processing transactions, these fees deter network spam, ensuring that resources are allocated efficiently. Moreover, the introduction of a minimum fee per transaction is a strategic move to guarantee fair compensation for the validators' efforts, contributing to the overall economic stability of Solana.

2. Economic Design

Solana aligns itself with the broader trend observed in blockchain networks, strategically transitioning from relying on inflationary rewards for short-term security to a model that places greater emphasis on transaction fees for long-term sustainability. This shift reflects the network's commitment to adapting and evolving, ensuring it remains economically viable and secure over an extended period.

3. Burning Fees

A distinctive feature of Solana's transaction fee structure is the burning of a fixed proportion of each fee. This intentional destruction of tokens serves a dual purpose. Firstly, it fortifies the value of the native SOL token, creating a deflationary mechanism that can positively influence the token's value over time. Secondly, burning fees act as a deterrent against malicious validators who might consider censoring transactions, as they would essentially be damaging a portion of the network's value.

4. Calculation of Transaction Fees

The calculation of transaction fees on Solana is a meticulous process, taking into account the base fee per signature and the computational resources utilized during a transaction, quantified in Compute Units (CU). This granular approach ensures that fees accurately reflect the real resources consumed, promoting fairness and transparency in the compensation model.

5. Priority Fees

Solana introduces a dynamic element with priority fees, allowing users to include an additional fee to expedite the processing of their transactions. This feature not only accommodates user preferences for faster execution times but also creates a competitive environment where transactions can be prioritized based on the willingness to pay an extra fee.

6. Staking Rewards

Beyond transaction fees, staking rewards constitute a crucial component of the Solana validator economics. This incentive structure encourages validators to remain online and actively participate in the consensus process. Staking rewards provide a stable revenue stream independent of transaction flow, fostering validator commitment and network security.

In conclusion, transaction fees are not just nominal charges on the Solana blockchain; they are the lifeblood that sustains the validators and, by extension, the entire network. Through intentional economic design, burning mechanisms, transparent fee calculations, and supplementary incentives, Solana establishes itself as a dynamic and resilient blockchain ecosystem, positioning transaction fees as a linchpin in its economic framework.

Solana vs World: Comparing Fee Economics

When comparing the fee economics of Solana with other popular blockchain networks like Ethereum, several key differences emerge:

1. Solana's Fee Structure

Solana's fee structure is designed to provide cost-effective and efficient transactions, with fees based on processing resources and data size rather than gas units. Solana uses a base fee and per-signature fee, aiming to deliver predictable and low-cost transactions.

2. Transaction Fees on Solana

Solana's transaction fees consist of a base fee and a priority fee. The base fee, currently set at 0.000005 SOL per signature, covers the right to use network resources, while the priority fee allows users to expedite their transactions for faster processing.

3. Incentives and Rewards

Transaction fees on Solana provide compensation to validators for processing transactions, reduce network spam, and contribute to the network's long-term economic stability. A portion of each transaction fee is burned to fortify the value of SOL and deter malicious behavior.

4. Ethereum's Gas Fee Structure

Ethereum operates on gas fees, where each operation in a smart contract uses a set quantity of gas. Gas prices vary based on network congestion and demand, leading to scalability challenges during periods of high demand. Ethereum is actively exploring layer-two solutions to address these issues.

5. Scalability and Speed

Solana's Proof of History consensus mechanism allows for faster transaction processing and lower fees compared to Ethereum. Solana's unique fee mechanism prioritizes efficiency and predictability in transactions, making it attractive for high-frequency trading and applications requiring frequent interactions.

In summary, while Solana focuses on efficient and low-cost transactions with its unique fee structure based on processing resources, Ethereum relies on gas fees that can become expensive during network congestion. Solana's design aims to provide a scalable platform with fast transaction processing capabilities, offering advantages in speed, scalability, and cost-effectiveness over Ethereum's gas fee model.

Impact of Fee Economics

The fee economics of the Solana blockchain exert a profound impact on the overall health, sustainability, and attractiveness of the network. Solana's strategic approach to transaction fees is not merely a technical consideration but a carefully crafted economic model that influences various aspects of the blockchain ecosystem.

1. Stimulating Validator Participation and Security

Transaction fees play a pivotal role in stimulating and sustaining validator participation in the Solana network. As validators are compensated for processing transactions, the economic model ensures a continuous incentive for them to remain active and contribute to the consensus process. This aspect is crucial for maintaining a robust and secure network. The fees create a direct link between the validators' efforts and their compensation, fostering a healthy ecosystem of active participants committed to securing the Solana blockchain.

2. Spam Deterrence and Resource Allocation

Transaction fees act as a deterrent against network spam, discouraging malicious actors from flooding the network with frivolous or irrelevant transactions. By introducing a cost associated with each transaction, Solana ensures that the network's resources are allocated efficiently. This not only protects the network from potential abuse but also contributes to a streamlined and optimized operation, enhancing the overall performance of the blockchain.

3. Long-Term Economic Stability and Transition from Inflationary Rewards

Solana's intentional transition from relying on inflationary rewards to depending more on transaction fees reflects a forward-thinking approach to long-term economic stability. While inflationary rewards may provide short-term security, the sustainable growth and viability of the network hinge on a fee-based model. This transition aligns Solana with the broader trend observed in blockchain networks seeking economic models that can adapt and endure over time.

4. Burning Mechanism and Value Fortification

The burning of a fixed proportion of each transaction fee is a unique feature that has a significant impact on the Solana blockchain's economic landscape. This deliberate destruction of tokens serves to fortify the value of the native SOL token, creating a deflationary mechanism. By reducing the circulating supply, burning fees can contribute to potential value appreciation over time. This mechanism not only protects the token's value but also acts as a deterrent against validators with malicious intent, as they risk damaging a portion of the network's value by censoring transactions.

5. User Experience and Transaction Prioritization

Transaction fees on Solana are not only about compensating validators but also cater to user preferences and experiences. The introduction of priority fees allows users to expedite their transactions by including an additional fee. This feature creates a dynamic and competitive environment where transactions can be prioritized based on the willingness to pay extra. Users gain control over the speed of transaction execution, enhancing their overall experience on the Solana blockchain.

6. Innovative Economic Mechanisms

Solana's fee economics extends beyond the basic compensation structure, incorporating innovative mechanisms such as MEV revenue sharing, tipping contracts, reward multipliers for decentralization contributions, and redistributing burned supply or fee treasuries. These mechanisms add layers of sophistication to the economic model, encouraging diverse forms of participation and contribution to the Solana ecosystem.

In essence, the impact of fee economics on the Solana blockchain network is multifaceted and far-reaching. It extends beyond the transactional aspect, shaping the behavior of validators, safeguarding against network abuse, fortifying the value of the native token, and enhancing the overall user experience. Solana's intentional design choices in fee economics underscore its commitment to creating a sustainable, secure, and dynamic blockchain ecosystem that thrives in the evolving landscape of decentralized technologies.

Negative Commission Rates

The Solana blockchain, known for its speed and efficiency, has introduced a unique concept in its fee economics - negative commission rates. This innovative approach challenges traditional fee structures and offers insights into the evolving dynamics of blockchain economics.

Exploring Negative Commission Rates

Purpose: Negative commission rates on Solana aim to incentivize validators by providing additional rewards beyond transaction fees. This mechanism encourages active participation in consensus and network maintenance.

Impact: By offering negative commission rates, Solana enhances the economic incentives for validators, promoting network security and decentralization. Validators are rewarded not only through transaction fees but also through additional incentives, fostering a robust and engaged validator community.

Challenges and Benefits

Economic Dynamics: Negative commission rates introduce a new dimension to validator economics, potentially influencing validator behavior and participation levels. This innovative approach can lead to increased network security and reliability by incentivizing validators to remain active and engaged.

Community Engagement: The introduction of negative commission rates reflects Solana's commitment to fostering an active and participatory ecosystem. By rewarding validators beyond standard transaction fees, Solana encourages sustained involvement and contribution from its validator community.

Comparative Analysis

Distinguishing Feature: While negative commission rates are a unique feature of Solana's fee economics, they set the network apart from other blockchain platforms. This innovative approach showcases Solana's dedication to creating a dynamic and engaging environment for validators.

Competitive Advantage: The implementation of negative commission rates underscores Solana's forward-thinking approach to incentivizing network participants. By offering additional rewards to validators, Solana enhances its appeal as a platform that values active engagement and contribution.

Future Implications

Sustainability: The integration of negative commission rates on Solana demonstrates the network's commitment to long-term sustainability and growth. By aligning economic incentives with active participation, Solana aims to build a resilient ecosystem that thrives on community engagement.

Innovation

As Solana continues to refine its fee structures and economic models, the concept of negative commission rates serves as a testament to the network's innovative spirit. This forward-looking approach positions Solana as a platform that prioritizes the well-being and involvement of its validator community.

In conclusion, the introduction of negative commission rates on the Solana blockchain represents a significant step towards redefining fee economics in the blockchain space. By incentivizing validators with additional rewards, Solana not only enhances network security but also fosters a culture of active participation and collaboration within its ecosystem. This innovative approach underscores Solana's commitment to creating a sustainable and engaging platform for all stakeholders involved in its vibrant community.

Cost of being a Validator

Being a validator on the Solana blockchain network comes with both costs and rewards, shaping the economic landscape for participants. Let's delve into the financial aspects of being a validator on Solana:

Financial Considerations

Annual Costs: The annual cost of running and securing the Solana blockchain amounts to approximately $50 million. This cost includes high-end server requirements such as 256 GB of RAM, 1 TB of SSD storage, and a 40 Gbps network connection per validator.

Revenue Generation: Despite the significant costs, validators on Solana can earn rewards averaging around $200,000 per year. This positive return on investment is crucial for sustaining validator operations and incentivizing active participation within the network.

Operational Expenses

Hardware Investment: Validators need to invest in high-performance hardware, bandwidth, and electricity to ensure reliable node operation. These upfront costs are essential for maintaining network integrity and performance.

Competition and Sustainability: Validators must navigate competition among peers for block production opportunities while managing operational expenses like hardware maintenance, bandwidth costs, and energy consumption. Balancing income with operational costs is key to ensuring long-term sustainability.

Supportive Initiatives

Foundation Assistance: The Solana Foundation provides support to validators by covering voting costs for the first year, gradually reducing this support over subsequent quarters. Additionally, the Foundation matches external stakes up to a certain cap, doubling validators' total stake and encouraging community-driven staking decisions.

Network Growth Impact: The economic viability of validators is closely tied to the growth of the Solana network. Increased adoption and on-chain activity lead to higher transaction volumes and fees for validators. However, managing operational costs remains crucial to ensure profitability amidst network expansion.

Future Considerations

Adaptability: Validators must stay abreast of technological advancements and updates within Solana to optimize their operations. Factors like deterministic scheduling, long-term staking incentives, programmatic slashing, and client upgrades like Firedancer will shape validator economics in the future.

Economic Alignment: As Solana evolves, validators will need to align their strategies with changing economic dynamics. Diversifying revenue streams, managing operational costs efficiently, fostering network growth, and adapting to governance changes will be critical for sustained success within the ecosystem.

In conclusion, being a validator on the Solana blockchain network involves significant financial commitments but also offers substantial rewards. By carefully managing operational costs, leveraging supportive initiatives from the Solana Foundation, and adapting to evolving economic landscapes, validators can contribute meaningfully to network security while ensuring their sustainability and profitability in the long run.

The Future of Validators

As the Solana blockchain continues to evolve, the role of validators stands at the forefront of ensuring network security, efficiency, and decentralization. The future of validators in Solana holds significant promise, driven by innovative incentives and a commitment to enhancing the overall user experience.

Tackling Validator Incentives

Evolving Landscape: Solana is actively addressing validator incentives amidst decreasing inflation rates, aiming to bolster network security and enhance user interactions. This proactive approach reflects a strategic focus on sustaining a robust validator ecosystem.

.

Important Prerequisites for Validators

Technical Expertise: Becoming a Solana validator requires a blend of technical knowledge, community engagement skills, and marketing acumen. From high-performance hardware to Linux system administration proficiency, validators must meet stringent requirements to ensure optimal network performance.

Hardware Performance: Validators need to maintain hardware performance standards and adhere to best practices for cluster and node monitoring. This emphasis on hardware excellence underscores the critical role that validators play in maintaining network integrity.

Enhancing Validator Economics

Negative Commission Rates: Solana's introduction of negative commission rates offers a unique incentive structure for validators, encouraging active participation and engagement. This innovative approach aims to further strengthen network security and reliability by rewarding validators beyond standard transaction fees.

Foundation Support: The Solana Foundation's initiatives, such as covering voting costs for new validators and matching external stakes, demonstrate a commitment to fostering a thriving validator community. These supportive measures aim to assist validators in overcoming initial costs while promoting sustainable growth within the network.

Network Health and Resilience

Continuous Improvement: The Solana Foundation's efforts to enhance validator network health through metrics like node count, consensus nodes, and Nakamoto Coefficient highlight a commitment to resilience and reliability. By focusing on software-level health and supporting core developers, Solana aims to fortify its network against potential crises.

Looking Ahead

Technological Advancements: Validators on Solana must stay abreast of technological developments and updates to ensure optimal performance. Considerations around deterministic scheduling, long-term staking incentives, programmatic slashing, and client upgrades like Firedancer will shape the future landscape for validators.

Adaptability and Innovation: As Solana continues to innovate and implement changes, validators must adapt their operations and strategies to align with evolving network dynamics. Embracing future upgrades and enhancements will be crucial for maintaining competitiveness and efficiency within the ecosystem.

In conclusion, the future of validators in the Solana blockchain network is marked by innovation, resilience, and community-driven growth. With a strong focus on incentives, technical excellence, and network health, Solana is poised to empower validators as key stakeholders in shaping the blockchain landscape of tomorrow.

Innovation to Support Validator Sustainability

The Solana blockchain network is actively implementing innovative initiatives to support validator sustainability, enhance network security, and foster decentralization. Let's explore the advancements in this realm:

Geographical Distribution Initiatives

Resilience Enhancement: Solana is introducing initiatives to promote a more geographically distributed stake among validators. This strategic move aims to bolster network resilience against potential attacks and outages, ensuring a more robust and secure ecosystem.

Foundation Support and Incentives

Financial Assistance: The Solana Foundation plays a crucial role in supporting validators by covering voting costs for new validators and matching external stakes up to a certain limit. These financial incentives aim to facilitate the entry of new validators into the network while promoting sustainable growth and participation.

Network Health Optimization: Efforts are underway to continuously monitor the network's health, optimize stake distribution, and enhance validator performance. By focusing on metrics like node count, consensus nodes, and Nakamoto Coefficient, Solana aims to fortify its network against potential crises and ensure long-term sustainability.

Technological Advancements

Redundancy Implementation: Innovations like running multiple validator nodes in different data centers with automated failover mechanisms are enhancing network reliability and uptime. These redundancy measures ensure continuous operation even in the face of node failures, contributing to overall network stability.

Cost-Saving Protocols: Protocols like StrongGate are being developed to help validators save on operational costs by enabling efficient failover solutions. These cost-saving mechanisms aim to optimize infrastructure operations and reduce expenses for validators within the Solana ecosystem.

Community Collaboration

Validator Alliances: Collaborative efforts among validators through alliances or delegator programs are fostering community engagement and knowledge sharing. By working together to improve network security and governance, validators can collectively strengthen the Solana ecosystem.

Continuous Research and Development: Ongoing research efforts within the Solana ecosystem focus on optimizing hardware and bandwidth for validators. These developments aim to make validator operations more efficient, cost-effective, and sustainable in the long run.

In conclusion, Solana's commitment to supporting validator sustainability through geographical distribution initiatives, foundation assistance, technological innovations, community collaboration, and ongoing research highlights a proactive approach toward ensuring a robust and resilient validator ecosystem. By embracing these advancements, Solana is paving the way for a sustainable future where validators play a crucial role in shaping the blockchain landscape.

Economic Mechanisms for Validator Incentives

The economic mechanisms governing validator incentives on the Solana blockchain are pivotal in ensuring network security, decentralization, and sustainability. Let's delve into the innovative approaches and strategies shaping validator incentives within the Solana ecosystem:

Direct Reward Mechanisms

Transaction Fees: Validators on Solana are directly rewarded for processing transactions, validating blocks, and executing smart contracts. As inflation decreases over time, transaction fees become increasingly important in covering infrastructure costs and sustaining validator operations.

MEV Revenue Sharing: Maximum Extractable Value (MEV) extraction rewards validators for swiftly settling decentralized exchange (DEX) arbitrage and on-chain operations. This mechanism incentivizes efficient transaction processing and contributes to overall network efficiency.

Tipping Contracts: Users can add priority fees to transactions to incentivize validator performance for specific transactions. This approach encourages validators to prioritize certain transactions, enhancing user experience and network responsiveness.

Innovative Economic Models

Enhanced Transaction Fee Structure: Transitioning from inflation-based rewards to transaction fee-centric incentives can significantly impact validator earnings. Calibrating fees thoughtfully is crucial to prevent user discouragement due to high charges while ensuring sustainable revenue streams for validators.

Fee Redistribution Framework: Introducing a system where validators share a portion of transaction fees with their delegators can foster community engagement and incentivize active participation within the network. This framework promotes a collaborative ecosystem where stakeholders benefit collectively.

Challenges and Considerations

Scalability Hurdles: Poorly structured fee mechanisms can hinder blockchain scalability, especially during periods of high network usage. Platforms with inefficient fee setups may struggle to handle increased transaction volumes, leading to delays and reduced network efficiency.

Stake Distribution Dynamics: In networks like Solana that utilize Proof of Stake (PoS) mechanisms, stake distribution plays a crucial role in validator incentives. By optimizing staking reward systems and economic incentives, validators can enhance their motivations and attract new participants to ensure network security and success.

Delegators in Solana

Delegators play a crucial role in the Solana blockchain network by contributing to network security, decentralization, and the growth of decentralized finance (DeFi) applications. Let's explore the dynamics of delegators within the Solana ecosystem based on the information gathered:

Delegating Stake for Network Security

Staking Rewards: Delegators contribute to the network's security by staking their SOL tokens and delegating them to validator nodes. In return, they receive rewards in the form of newly minted SOL tokens. This process not only secures the network but also incentivizes active participation and engagement.

Stake Delegation: Delegators entrust their staking rights to validator nodes without giving them access to their funds. Validators perform the essential task of replaying the ledger and participating in consensus, while delegators play a vital role in supporting these operations through stake delegation.

Risk Management and Governance

Slashing Mechanism: Validators and their delegators are subject to potential punishment through slashing in case of malpractice, such as prolonged offline periods or double signing blocks. While exact parameters are yet to be released, this mechanism aims to maintain network integrity and deter malicious behavior.

Risk Factors: Delegators face risks like key mismanagement, protocol errors, or network attacks that could result in fund loss. Understanding these risks is crucial for delegators to make informed decisions and safeguard their assets within the Solana ecosystem.

Economic Considerations

Reward Calculation: Delegators' annual rewards comprise block rewards and transaction fees minus commission fees charged by service providers. These rewards are paid out at the beginning of each epoch, providing a steady stream of income for participants based on their staked amount.

Commission Fees: Service providers typically charge commission fees for their services, which are used to cover operating costs and reinvest in ecosystem development. Delegators should consider these fees when choosing validators to maximize their returns.

Operational Procedures

Stake Management: Delegators can create multiple stake accounts with unique addresses and delegate varying amounts of SOL tokens to different validators. Splitting tokens between multiple stake accounts allows delegators to diversify their staking strategies and engage with different validators.

Withdrawal Process: Tokens can be withdrawn from a stake account when they are not delegated. However, transferring additional SOL tokens into an already delegated account requires non-delegation followed by re-delegation, which may temporarily halt reward accrual during this transition period.

In summary, delegators play a vital role in securing the Solana blockchain network through stake delegation, contributing to network decentralization and growth. By understanding risk factors, economic considerations, and operational procedures associated with delegation, participants can actively engage in staking activities within the Solana ecosystem while maximizing their rewards and contributing to network resilience.

Personal Outlook on Solana and Validators

In the dynamic realm of blockchain technology, Solana emerges as a beacon of speed, efficiency, and innovation. With its capacity to process thousands of transactions per second, Solana has garnered significant attention from developers and users seeking a robust and high-performance blockchain solution. Behind this success lies a sophisticated network of validators and intricate fee economics that underpin the seamless operation of the Solana ecosystem.

Embracing Solana's Potential

Solana's rapid transaction speeds, low costs, and support for decentralized finance (DeFi) applications position it as a frontrunner in the competitive blockchain landscape. As its adoption continues to surge, driven by a vibrant development community and a commitment to scalability and decentralization, Solana is poised to revolutionize the cryptocurrency space. The network's throughput of over 65,000 transactions per second, coupled with its low transaction fees, sets a new standard for efficiency and accessibility in blockchain technology.

Unveiling the Role of Validators

Validators stand as the stalwart guardians of the Solana network, ensuring security, integrity, and efficiency in transaction processing. With over 1,000 validators meticulously verifying transactions and upholding network reliability, Solana's decentralized system guarantees swift and dependable transaction execution. However, the operational costs for validators can be substantial, with fees varying across the network.

Navigating Validator Dynamics

Solana's diverse array of validator clients underscores the network's commitment to resilience and decentralization. From Solana Labs' original client to independent efforts like Jito Labs' client with impressive throughput capabilities, the multi-client approach mitigates risks associated with single points of failure. The distribution of stakes among validator software clients reflects ongoing efforts to enhance decentralization and fortify network security.

Addressing Challenges and Solutions

Solana validators encounter a spectrum of challenges spanning technical complexities, economic risks, network outages, and hardware demands. To surmount these hurdles, Solana is actively pursuing solutions such as network upgrades, client diversity enhancements, stake distribution optimization, and initiatives like the Solana Foundation Delegation Program. These strategic measures aim to bolster network resilience, improve operational efficiency, and ensure sustainable growth within the ecosystem.

Fee Economics: A Pillar of Sustainability

Transaction fees on Solana play a pivotal role in sustaining validator economics by compensating validators for their crucial role in securing the network. Beyond mere compensation, fees deter spam activities, fortify network performance, and contribute to long-term economic stability. The intentional burning of a portion of each fee not only enhances the value of SOL tokens but also acts as a deterrent against malicious behavior. In conclusion, my outlook on Solana and validators underscores the network's resilience, innovation-driven approach to scalability, and commitment to fostering a robust ecosystem through efficient fee structures and diverse validator dynamics. As Solana continues to evolve and expand its decentralized infrastructure, it stands poised to shape the future of blockchain technology with its unparalleled speed, efficiency, and dedication to decentralization.

References

https://solana.com/news/validator-health-report-october-2023

https://www.helius.dev/blog/solana-nodes-a-primer-on-solana-rpcs-validators-and-rpc-providers

https://www.jito.network/blog/solana-validator-101-getting-started-with-solana-staking/

https://101blockchains.com/role-of-validators-in-solana-network/

https://www.solana-validator-guidebook.com/solana-introduction/

https://www.blockchain-council.org/blockchain/validators-in-solana-network/

https://www.umbraresearch.xyz/writings/solana-fees-part-1

https://www.helius.dev/blog/solana-fees-in-theory-and-practice

https://solanacompass.com/statistics/fees

https://solana.org/delegation-criteria

https://solana.com/validators

https://solana.org/delegation-program